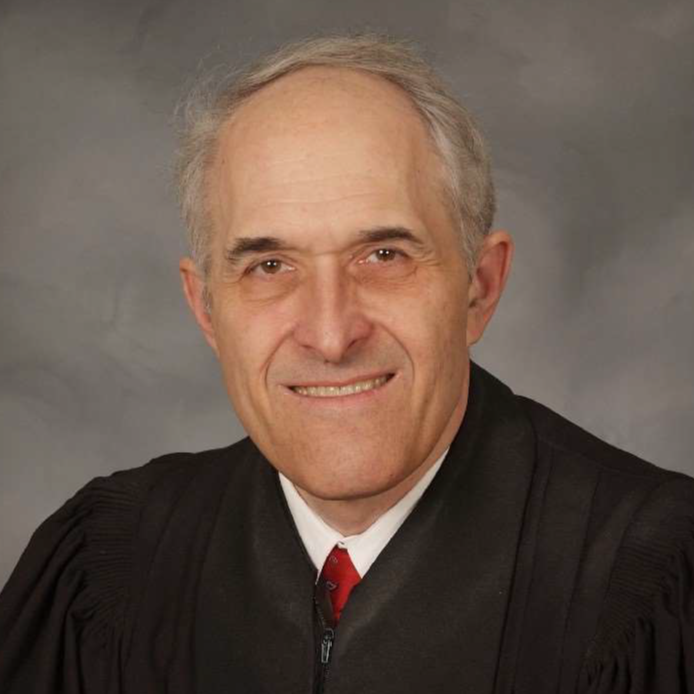

Hon. Carl L. Bucki

1993 – present

Federal Judicial Service:

- Judge, U.S. Bankruptcy Court, Western District of New York. Chief Bankruptcy Judge, 2007 – present.

- Member, 2nd Circuit Bankruptcy Appellate Panel, 1996-2000

Education:

- Cornell Law School, J.D., cum laude, 1976

- Cornell University, B.A., magna cum laude, 1974

Professional Career:

- Private Practice, Cohen Swados, Wright, Hanifin, Bradford & Brett, Buffalo, New York, 1990-1993

- Private Practice, Moot & Sprague, Buffalo, New York, 1983-1990

- New York Court of Appeals, Confidential Legal Assistant to Hon. Matthew J. Jasen, 1976-1977

Noteworthy Cases:

In re Bush Industries, Inc., No. 04-12295:

In this Chapter 11 case, the debtor proposed a plan providing for full payment of all claims other than a class of eight secured creditors. These secured creditors would then receive a proportionate interest in each of two secured notes and a prorata distribution of new common stock. All other prepetition stock would be cancelled. The Plan also provided what prepetition equity holders described as a “golden parachute” for the benefit of the debtor’s principal officer. In denying confirmation of the plan as originally proposed, the Court considered the duties that a debtor in possession owes to equity interests. The case is also notable for its explanation of appraisal methodologies.

In re Bush Industries, Inc., 315 B.R. 292 (Bankr. W.D.N.Y. 2004)

https://casetext.com/case/in-re-bush-industries

In re Colad Group, Inc., No. 05-10765:

Shortly after the filing of its bankruptcy petition, the debtor in this Chapter 11 case filed the following motions: a motion to authorize payment of prepetition employee compensation and benefits; a motion to authorize payment of prepetition sales and use taxes; a motion to specify adequate assurance of payment for postpetition utility services and to prohibit utilities from discontinuing, altering or refusing service; a motion to authorize the debtor to implement a key employee retention and incentive program for noninsiders; a motion to approve the employment of a restructuring consultant; a motion to approve the retention of bankruptcy counsel; a motion to authorize the debtor to maintain an existing cash management system and bank accounts and to authorize the clearing of checks in transit; and an application for emergency and final authority to obtain post-petition financing. In its ruling on these various requests, the Court explained the purpose and function of “firstday” orders in a Chapter 11 bankruptcy proceeding.

In re Colad Group, Inc., 324 B.R. 208 (Bankr. W.D.N.Y. 2005)

https://casetext.com/case/in-re-colad-group-1

In re Minor, Bankruptcy Case No. 09-12095, Adversary Proceeding No. 11-1036:

In this Chapter 7 case, the Court determined the enforceability of a presettlement finance agreement under which the debtor had received funds on account of an anticipated recovery of damages resulting from personal injury. The decision analyzes the application of New York law regarding usury and champerty. Judge Bucki ruled that although the financer could enforce its rights against exempt assets, those rights were “unenforceable against the superior legal interest of a bankruptcy estate.”

In re Minor, 482 B.R. 80 (Bankr. W.D.N.Y. 2012)